In the Piketty surge to the top of the best-seller list, there’s a misleading polemic evolving (and not from people who have read Capital, it turns out): it’s been attacked on the right as a new call for communism and heralded on the left as proof that capitalism simply doesn’t work.

Here is Patapaa’s take on Piketty’s arguments, in 10 figures from the book. An excellent and detailed analysis by Jehuti Nefekare can also be found here.

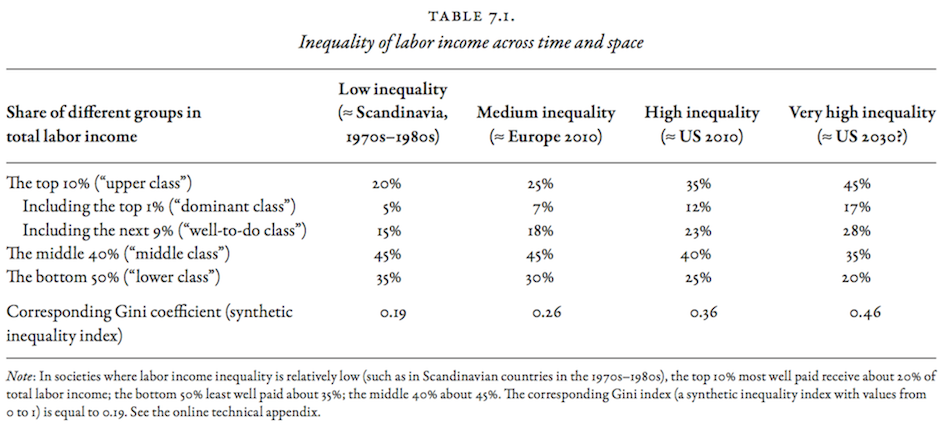

1. A person’s income in the United States is comprised of labor income and capital income. Let’s look at labor income first. The top 10% of American earners currently receive 35% of all wages (labor income), while the top 1% receive 12%. Europe, and especially the Scandinavian countries, has far lower levels of labor income inequality.

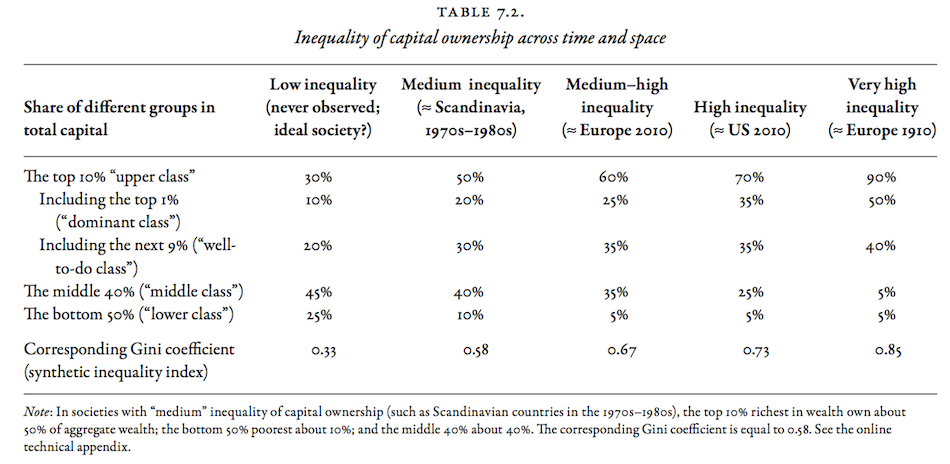

2. But both Europe and the United States have high levels of capital inequality, with the top 10% owning 60% of all capital in Europe and 70% of all capital in the United States. We’re not yet at European turn of the century levels, though, when the top 10% owned 90% of all capital, but we’re certainly heading in that direction.

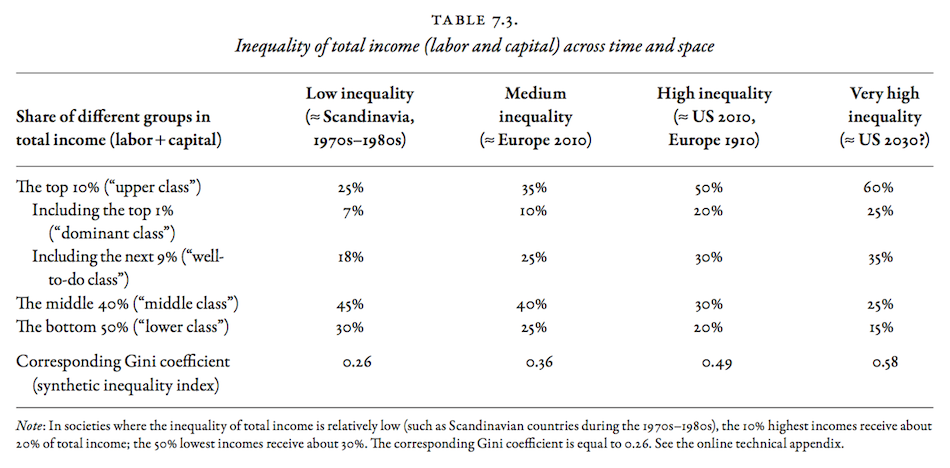

3. When we combine labor income and income from capital, we get total income. 50% of total income goes to the top 10% in the United States, while 20% goes to the top 1%. In 2030, Piketty predicts that 60% of all income will go to the top 10% of Americans.

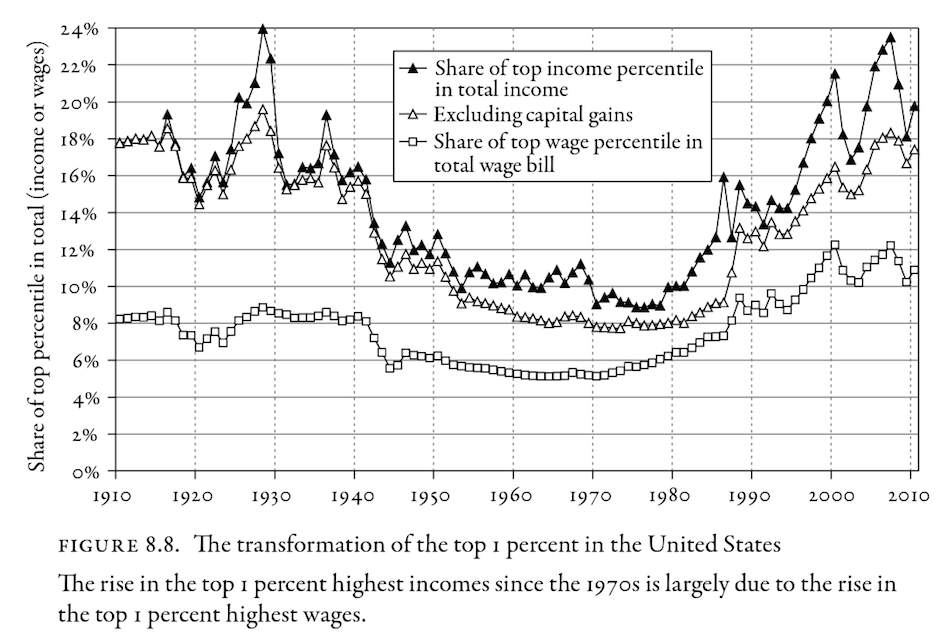

4. In the United States, the top 1% are doing well because of extraordinarily high wages, which leads to rapid capital accumulation. Piketty calls these high-earners “supermanagers,” the financial and non-financial executives who set their own salaries.

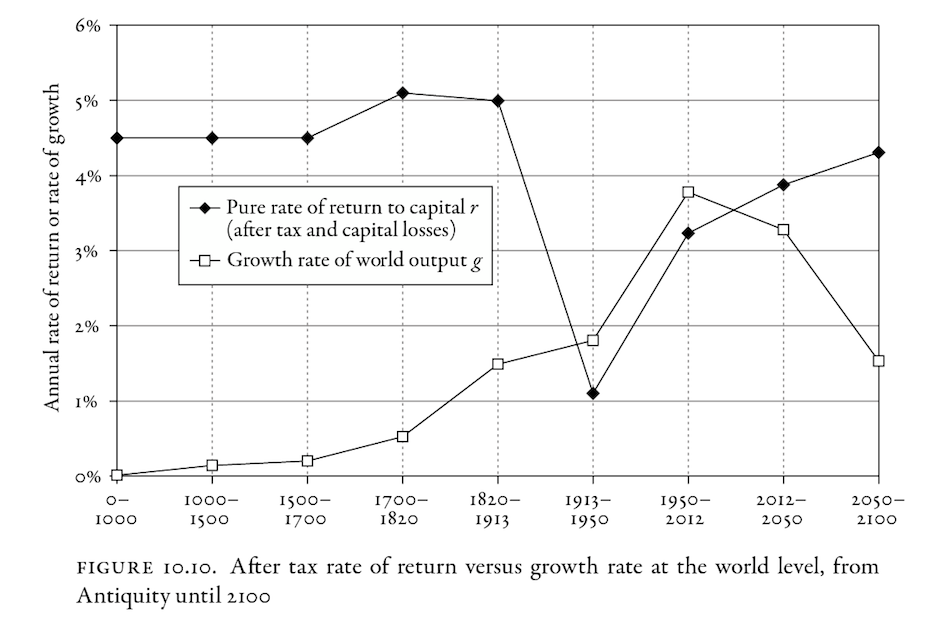

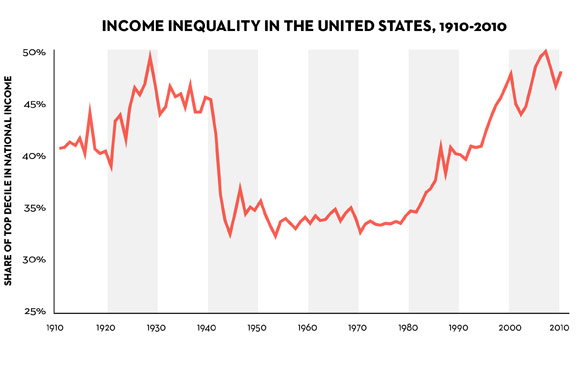

5. Taxes, combined with huge capital losses in WWI and WWII, resulted in a rate of return to capital (r) lower than the global growth of GDP (g) during the last century. Because r < g, income inequality decreased during the postwar period and stayed flat until 1980.

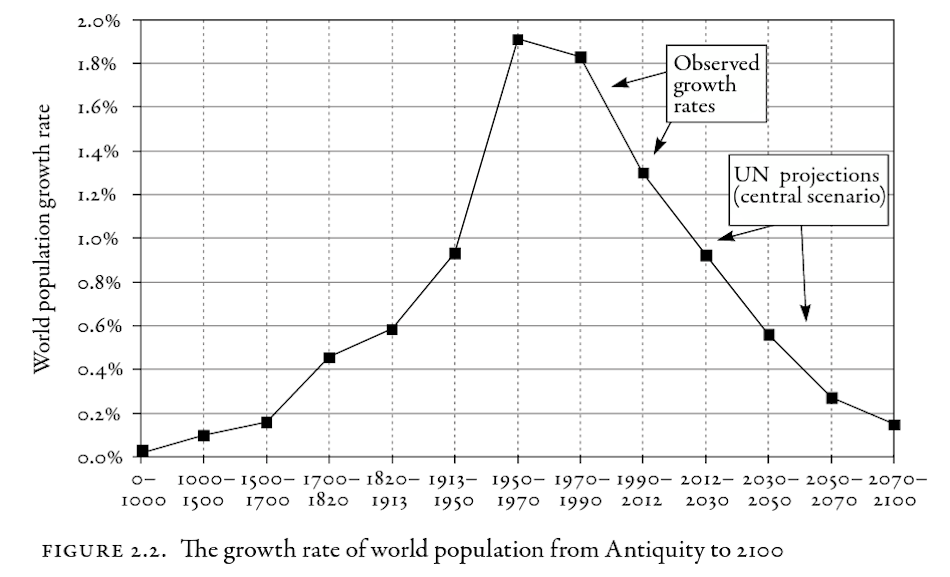

6. But global economic growth is largely an effect of population growth, which can’t continue at current rates.

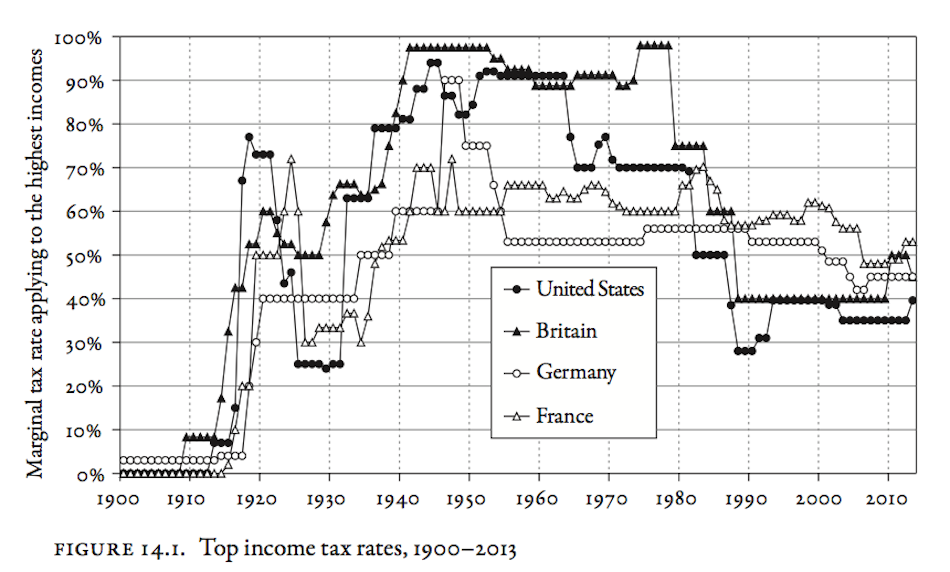

7. And top marginal tax rates are still low, especially in the United States.

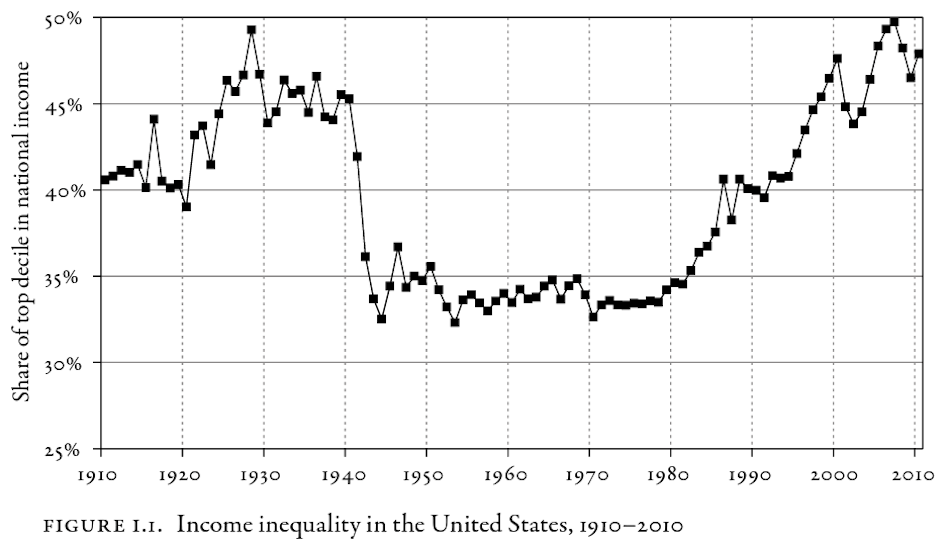

8. With r < g, income inequality dropped dramatically in the United States during the postwar period. Now that r > g, income inequality is on the rise once again.

9. So is the world capital/income ratio

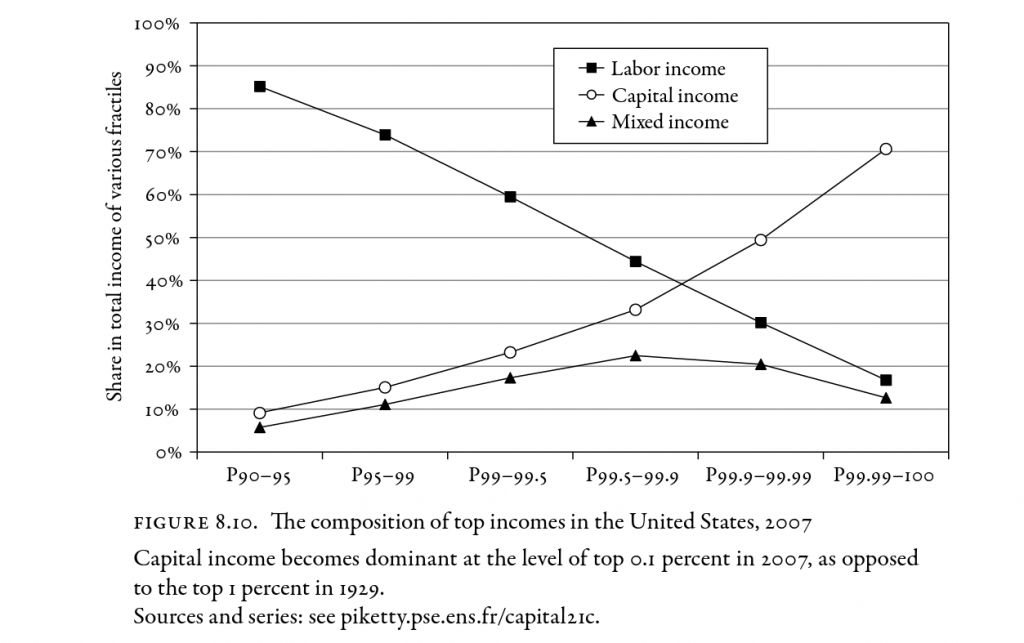

10. And who benefits most from capital income (in other terms, who receives the majority of their income from capital income rather than labor income)? Not the top 10%, 5%, or even 1%, but the top .1%!

Thanks for this piece. A concise way to grasp this book which I cannot seem to find anywhere to buy. The lessons learned here in Piketty’s analysis are many and only if our African heads of state read??

Top .1% controls everything? What is the rest of the world to do?